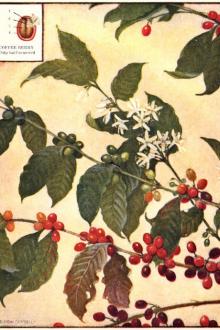

All About Coffee by William H. Ukers (best new books to read .TXT) 📕

CHAPTER II

HISTORY OF COFFEE PROPAGATION

A brief account of the cultivation of the coffee plant in the Old World, and of its introduction into the New--A romantic coffee adventure Page 5

CHAPTER III

EARLY HISTORY OF COFFEE DRINKING

Coffee in the Near East in the early centuries--Stories of its origin--Discovery by physicians and adoption by the Church--Its spread through Arabia, Persia, and Turkey--Persecutions and Intolerances--Early coffee manners and customs Page 11

CHAPTER IV

INTRODUCTION OF COFFEE INTO WESTERN EUROPE

When the three great temperance beverages, cocoa, tea, and coffee, came to Europe--Coffee first mentioned by Rauwolf in 1582--Early days of coffee in Italy--How Pope Clement VIII baptized it and made it a truly Christian beverage--The first Europe

Read free book «All About Coffee by William H. Ukers (best new books to read .TXT) 📕» - read online or download for free at americanlibrarybooks.com

- Author: William H. Ukers

- Performer: -

Read book online «All About Coffee by William H. Ukers (best new books to read .TXT) 📕». Author - William H. Ukers

Following a rally to nineteen and six-tenths cents during the next month (July, 1887), the pendulum again swung downward. The climax came with the culmination of the "European fiasco" of the spring of 1888. Reports were received that various European coffee firms had failed; and future contracts in the American market sold as low as nine cents in March.

A Famous European Bull Campaign

The next campaign of interest lasted more than two and a half years. In September, 1891, there was a corner in the local market which forced the September price up to seventeen and one-quarter cents. George Kaltenbach, a wealthy speculator living in Paris, combining with three operators in Havre, Hamburg, and Antwerp, succeeded in breaking the corner, forcing the price down to ten and eight-tenths cents. They then changed to the bull side, buying heavily in all markets of the world. This was continued until early in 1893, bringing the price back to fifteen cents. Although his associates then returned to the bear side, Kaltenbach kept on buying; and aided by bad crop reports from Brazil, he worked the price up as high as seventeen and seven-tenths cents. At one time it was said that his profits were more than one million dollars. The collapse of this deal occurred in May, 1893, involving thirty firms in Hamburg, Havre, and Rotterdam. As Kaltenbach could not keep his large New York holdings margined, they were thrown on the market, bringing about a sharp break, and causing the failure of his New York agents, T.M. Barr & Co.

The present era of large crops began in 1894, Brazil's production for 1894–95 being placed at 6,695,000 bags. Nevertheless, Guzman Blanco, a former president of Venezuela, then living in Paris, and said to be worth about $20,000,000, attempted to run a corner in April, 1895. He bought 200,000 bags of spot coffee in Havre warehouses and accumulated a big line of futures in various markets. Assisted by reports of cholera in Rio and some reduction in Brazilian crops, he enjoyed temporary success, the price of Rio 7s in New York rising to fifteen and one-half cents in October, 1895. Thereafter, there was an almost continuous decline. In the spring of 1898, a vigorous bear campaign was conducted, largely in the form of market letters; and by November, Rio 7s here had dropped to four and one-half cents.

The Bubonic Plague Boom

The so-called "bubonic plague boom" halted this prolonged downward movement for a time in 1899–1900. The boom derived its name from the outbreak of bubonic plague in Brazil, as a result of which the ports of that country were quarantined. In addition, Brazilian steamers arriving at New York were placed in quarantine; and the impossibility of unloading their cargoes caused a temporary shortage. As a result, prices rose from four and one-quarter cents in September, 1899, to eight and one-quarter cents in July, 1900. The quarantine being lifted, the bears again became aggressive; and by April, 1901, they had forced the price back to five cents.

There was another short-lived attempt to establish a corner in September, 1901. Receipts at Rio and Santos had been running light, encouraging a local clique embracing Skiddy, Minford & Company; W.H. Crossman & Bro.; and Gruner & Company, to endeavor to gain control. The arrivals at Brazilian ports suddenly increased to the largest volume ever known up to that time; and, with vigorous opposition from operators in Havre, the corner here was speedily broken.

The opening of the new century witnessed the beginning of another new coffee era, Santos permanently displacing Rio as the world's largest source of supply. The figures for 1900–01 were: Santos, 2,945,000 bags; Rio, 2,413,000 bags.

Huge crops then became a regular thing in Brazil. That of 1901–02 was far in excess of estimates, being 15,000,000 bags; while 20,000,000 bags were produced in 1902–03. As a result, the world's coffee trade became completely demoralized for the time being. In August, 1902, contracts for July, 1903, delivery sold at six and one-tenths cents. By June, 1903, they had fallen to three and fifty-five hundredths cents, the lowest price ever recorded for coffee.

The Southern Boom

As is invariably the case when prices reach extreme levels, either high or low, the pendulum swung back rapidly in the other direction. Based on the unprecedentedly low prices, the so-called "cotton crowd" started what was generally known as "the southern boom". Various cotton traders in New York and the South, under the leadership of D.J. Sully, the one-time "cotton king", and ably assisted by prominent local coffee firms, became extremely active on the buying side; and by February, 1904, they had forced the price up to eleven and eighty-five hundredths cents. This figure, the highest since 1896, was reached on February 2, which proved to be another day of enormous speculative dealings, involving roundly 462,000 bags. This marked another turning point; the three succeeding days of record-breaking operations on the Exchange witnessing a break of roughly two cents. Mr. Sully went on a vacation on February 3, and the Sielcken interests sold on a large scale. Business for that day was placed at 555,000 bags, closing prices being about one-half cent lower. This brought on enormous liquidation by western bulls on the following day, approximately 500,000 bags. As a result, prices lost twenty-five to sixty-five points on a turn-over of about 642,000 bags. All records for business were smashed on the following day, February 5. The official record was 689,000 bags, but trade estimates made it more than 1,000,000 bags. On that day, southern interests liquidated heavily, causing net losses of eighty to ninety points. Doubtless the break would have been more severe had it not been for buying by the Sielcken people and several other strong interests at and below seven and one-quarter cents for September contracts.

The Story of Valorization

The valorization, or equalization, of coffee originated in Brazil. When the original plan was threatened with disaster, Hermann Sielcken stepped in and saved the Brazil planters from ruin; the Brazil government from possible revolution; and, incidentally, won for himself and those who were his partners in the enterprise much unenviable notoriety.

The principle of valorization is generally conceded to be economically unsound, because it encourages overproduction. And valorization in Brazil would have been a failure, had it not been for a fortuitous combination of short crops, Hermann Sielcken's genius, and the World War. Because of the lessons learned in this experience, Brazil's subsequent valorization enterprises have run more smoothly.

A rapidly increasing world demand, a wonderfully fertile soil, and cheap labor kept the Brazil coffee industry in a flourishing condition nearly to the close of 1889. Coffee consumption was increasing, especially in the United States. By April 1890, the average import price per pound of Rio No. 7 in this country was nineteen cents; and Brazil was supplying only about half our needs. Virgin soil was still available in Brazil, and immigration furnished all the needful labor. Easy profits led to increased investment and careless methods. Her planters were drunk with prosperity. For six years, nearly all the three million inhabitants of São Paulo, Brazil's largest coffee producing state, "entirely gave up planting corn, rice, beans, everything they needed. They bought them because coffee was so immensely profitable that they put all their labor in coffee."

Brazil had been going through a period of low exchange. Paper money fell below par. The exaggerated issues of it, which provoked the collapse of exchange, suddenly endowed Brazil with an abundant circulation of money. Production was enormously stimulated. New undertakings sprang up on every hand. Armies of agricultural laborers were recruited in Europe and shipped into the coffee districts. And then, to make the story short, supply passed demand, surplus stocks began to appear, prices began to fall, and fell until they dropped below the cost of production.

It was in 1896–97, when the new trees came into bearing by the tens and hundreds of thousands, that São Paulo's folly began to tell. By October of that year the price of Rio No. 7 in New York had fallen to about seven cents. The decline continued, until, in 1903, it hung around five cents. Then began the winter of São Paulo's discontent. Too late, the state government tried by taxing new coffee estates, to force the planters to raise crops to supply their own necessities. The times grew harder.

Mortgages held by large coffee houses and bankers were being foreclosed. The industry was passing into European hands. The smaller planters were becoming desperate; and desperation is only a step from revolution. The government of the state of São Paulo knew this; and to save the state, it finally promised it would buy the next coffee crop, and would hold it for the planters at such a price as would be necessary to continue the industry. The protagonists of this plan to valorize coffee were Dr. Jorge Tibiriçá, Dr. Augusto Ramos, and Dr. Albuquerque Lins.

During all the period covering São Paulo's rise and fall in coffee, the financial genius who was to lead her again into the land of plenty had been quietly acquiring a knowledge of her problems—also, the ability to make money out of their solution.

Valorization was undertaken to save the coffee industry. Its intent was good, even if the theory was bad. The scheme was not new, and there were no encouraging precedents to augur its success. The situation was desperate and seemed to justify the trial of a desperate remedy. São Paulo attempted to carry the load; but her resources were insufficient.

The bumper world crop of 19,090,000 bags in 1901–02 was followed, in 1906–07, with another extraordinary yield of 24,307,000 bags, of which Brazil alone produced 20,192,000 bags. To make good its promise to the planters, ready cash was needed; and so the São Paulo government sent a special commissioner to Europe to get it. For sixty years the Rothschilds had acted as Brazil's bankers. The commissioner went to the Rothschilds first. He was flatly refused. After that, he was turned down by practically every bank on the continent. It looked as if the bankers had entered into a gentlemen's agreement to make it unanimous. Then the commissioner bethought himself of the coffee merchants; and that thought naturally suggested Hermann Sielcken, who, singularly enough, happened to be conveniently resting at nearby Baden-Baden. In August, 1906, the commissioner waited upon Mr. Sielcken and begged his aid.

It was Sielcken's hour of triumph. For years he had been soliciting Brazil. Now the tables were turned, and Brazil was asking favors of Sielcken.

The rest of the story is best told by Robert Sloss, who wrote it for World's Work from information furnished by trade authorities—and even by Mr. Sielcken, himself, in various speeches, newspaper articles, and on the witness stand. It is presented here with certain minor corrections by the author:

"Well, what do you want me

Comments (0)