All About Coffee by William H. Ukers (best new books to read .TXT) 📕

CHAPTER II

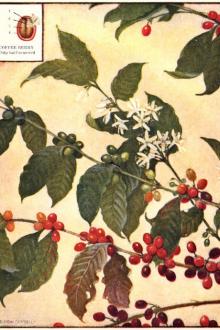

HISTORY OF COFFEE PROPAGATION

A brief account of the cultivation of the coffee plant in the Old World, and of its introduction into the New--A romantic coffee adventure Page 5

CHAPTER III

EARLY HISTORY OF COFFEE DRINKING

Coffee in the Near East in the early centuries--Stories of its origin--Discovery by physicians and adoption by the Church--Its spread through Arabia, Persia, and Turkey--Persecutions and Intolerances--Early coffee manners and customs Page 11

CHAPTER IV

INTRODUCTION OF COFFEE INTO WESTERN EUROPE

When the three great temperance beverages, cocoa, tea, and coffee, came to Europe--Coffee first mentioned by Rauwolf in 1582--Early days of coffee in Italy--How Pope Clement VIII baptized it and made it a truly Christian beverage--The first Europe

Read free book «All About Coffee by William H. Ukers (best new books to read .TXT) 📕» - read online or download for free at americanlibrarybooks.com

- Author: William H. Ukers

- Performer: -

Read book online «All About Coffee by William H. Ukers (best new books to read .TXT) 📕». Author - William H. Ukers

Valorization had the effect of stabilizing the Brazil market, and giving the planters and allied interests the assistance they needed to ward off the disaster that threatened them through overproduction. The United States government action in 1912 forced the sale of the valorized stocks held in this country, and the Congress passed the law making it impossible again to offer for sale in America stocks of coffee held under similar valorization agreements.

The coffee situation became so serious in 1913, that São Paulo again entered the money market for another loan, borrowing $37,500,000 through the good offices of the Brazilian federal government, following this up two years later with another loan of $21,000,000. According to a semi-official statement issued in Brazil early in 1919, the status of valorization at that time was that the first loan of $75,000,000 of 1908, had been entirely liquidated, and the two later loans were greatly reduced. At the same time, it was announced by the president of the state of São Paulo that the surtax of five frances would be withdrawn as soon as the liquidation of the loans had been completed. This surtax, however, is still in effect. In 1919, the São Paulo government proposed advancing the pauta, or export duty, very materially. A strong protest was made by all the exporters; and a compromise was at last effected by which the proposed increase in the pauta was canceled, and the existing surtax of five francs per bag continued as an offset.

The valorization project just described was the second of its kind, a former attempt having proved a failure. At that time (1870), the Brazilian government had been a large purchaser of Rio coffee, buying it in lieu of exchange, as it had large remittances to make. The coffee was sold through G. Amsinck & Co., and it is believed that heavy losses were sustained.

Since the Sielcken valorization enterprise, the Brazilian government has promoted two more valorizations, one in 1918, another early in 1922.

War-Time Government Control of Coffee

The board of managers of the New York Coffee and Sugar Exchange, Inc., had realized, late in 1917, that war-time government control of coffee trading was likely in view of the government's activities in other commodities. To guard against the danger of a sudden announcement of such action, the president of the Exchange was empowered from month to month, at each meeting of the board, to suspend trading at any time that conditions warranted; so that, when President Wilson announced, on January 31, 1918, that all dealers in green coffees were to be licensed, the Exchange was fully prepared. Trading was suspended pending further information, and owing to the farsightedness of the board of managers, all danger of a panic in the market was averted.

By 1917, the allies had stopped shipments of coffee to Germany through neighbors who had been her sole source of supply. Stocks in all the producing countries were accumulating, and São Paulo had embarked on another valorization scheme to protect her planters. The markets of Europe were entirely controlled by the governments; and the United States was practically the only free and open market. The market here was steady and without particular animation, and showed none until the end of November, 1917. At that time, speculation activities, steamer scarcity, and the steady advance in freights, became decided influences in the market; and prices began to advance.

Freights on shipments from Brazil had advanced from one dollar and twenty cents per bag early in the year to unheard-of prices; and, before the bubble burst, had reached as high as four dollars per bag. With this steadily advancing freight, speculation in coffee became more active; and prices naturally began to rise. The relative cheapness of coffee compared with all other commodities; the fact that coffee here had shown very little advance; the prospect of an early peace; the large European demand to follow; were favorite bull arguments. The market became excited; speculative buying was general, every one, apparently, wanted to buy coffee; and twenty cents per pound for Santos 4s in the near future was a common prediction.

The United States food administrator had shown his antipathy to uncontrolled exchange operations by his action on sugar, wheat, corn, and other commodities, dealt in on the exchanges; consequently, the proclamation of President Wilson regarding coffee was not a surprise to those who had been watching the situation closely, especially as on January 30, 1918 (the day before the proclamation) the president of the Coffee Exchange was summoned by telegraph to appear in Washington to discuss ways for a proper control of the article, and the best means to bring about such control. As a result of this summons, a committee of the entire trade, representing the Exchange, the green-coffee dealers and importers, the roasters, and the brokers, was appointed by the Exchange to confer with the food administrator at once, in order to work out a plan whereby the business could be kept going. After a long conference, rules agreed upon were approved that became the basis on which business was conducted until the withdrawal of all regulations regarding coffee in January, 1919. Much trade criticism followed the publication of some of these rules.

George W. Lawrence, president of the New York Coffee and Sugar Exchange, was called to Washington on February 28, 1918, to take charge of a newly created coffee division under Theodore F. Whitmarsh, chief of the distribution division of the food administration. In this position he rendered a signal service to the trade and to his country. Although subjected to a cross-fire of criticism from many green and roasted coffee interests, he never wavered in the performance of his full duty; and his good judgment, tact, and loyalty to American ideals, won for him a high place in the regard of all those who had the best interests of the country at heart. He was ably assisted in his work by Walter F. Blake, of Williams, Russell & Company, New York; and by F.T. Nutt, Jr., treasurer of the New York Coffee and Sugar Exchange.

A coffee advisory board was appointed in June 1918, to serve as a go-between for the trade and the food administration. Those who served on this committee were: Henry Schaefer, of S. Gruner & Co., New York, chairman; Carl H. Stoffregen, of Steinwender, Stoffregen & Co., New York, secretary; and William Bayne, Jr., of William Bayne & Co., New York; S.H. Dorr, of Arnold, Dorr & Co., New York; A. Schierenberg, of Corn, Schwarz & Co., New York; Leon Israel, of Leon Israel & Bro., New York; Joseph Purcell, of Hard & Rand, New York; B.F. Peabody, of T. Barbour Brown & Co., New York; J.D. Pickslay, of Williams, Russell & Co., New York; Charles L. Meehan, of P.C. Meehan & Co., New York; B.C. Casanas, of Merchants Coffee Co., New Orleans; John R. Moir, of Chase & Sanborn, Boston; and B. Meyer, of Stewart, Carnal & Co., New Orleans.

Others in the trade who served the food administration during the period of the World War were George E. Lichty, president of the Black Hawk Coffee & Spice Co., Waterloo, Iowa; and Theodore F. Whitmarsh, vice-president and treasurer of Francis H. Leggett & Co., New York.

The visible supply of coffee for the United States on January 1, 1918, was 2,887,308 bags. The world's visible supply was given as 10,012,000 bags; but to be added to this were more than 3,000,000 bags held by the São Paulo government. Thus there was little reason to fear a coffee shortage. That coffee should be permitted, with this large amount in view, to run wild as to price, was certainly not the intention of the food administrator, whose purpose was to keep foods moving to the United States forces and allies, and as far as possible, to keep reasonable prices for the United States consumers. Steadily advancing prices of foods meant increasing cost of labor, general unrest, and a difficult situation to meet at a period when the situation as a whole was most critical.

Trouble for the coffee trade was imminent early in 1918, when the shipping board, backed by experts, decided, or attempted to decide, that coffee was not a food product; that no vessels could be had for its transportation; and that it must be put on the list of prohibited or restricted commodities. Mr. Hoover, however, insisted that coffee was a very necessary essential, and that tonnage must be provided for an amount sufficient at all times to keep the visible supply for the United States up to at least 1,500,000 bags of Brazil coffee; and this figure was ultimately accepted and carried out by the shipping board.

These figures, based on the deliveries of the two preceding years, and with dealers limited to ninety days stock in the country, were deemed ample to care for all requirements. It was figured that by November 1, 1918, the freight situation would be relieved to such an extent by the new vessels building, that the amount could be increased should it be found necessary. The food administration, through the war trade board, offered steamer room to importers of record of the years 1916–17 at $1.70 per bag. The first few vessels were promptly filled on a basis of nine and one-quarter to nine and five-eighths cents, c. & f., for Santos 4s, well described. About the same time, our army and navy were able to buy at eight to eight and three-eighths cents f.o.b. Santos, for shipment by their own vessels. After the first few vessels offered by the War Trade Board were filled, the trade became indifferent. The warehouses in Brazil were loaded with stocks; vessels to carry coffee were assured buyers at a fixed rate (profits limited); and, as there was no apparent reason for an advance, buyers were willing to let the producing countries carry the stock.

The last week in June brought very cold weather in São Paulo, and cables reported heavy frost. The news was not taken seriously by the trade at large. "Frost news" from Brazil was no novelty, and in the past had always been looked upon as a regular and seasonable method of bulling the market. This year, however, the frost was a fact, and the market began to move upward with surprising speed. Reports of the damage to the trees varied from forty to eighty percent. Quotations from Santos advanced two cents per pound in as many days. United States buyers were not disposed to follow the advance; offerings of steamer room were declined; and boats booked for coffee, owing to the lack of cargoes, were transferred elsewhere. Meanwhile the market continued to advance rapidly. The allies were holding the enemy, and peace prospects were brighter. From September 1 to November 15, the records of the food administration showed very small purchases. The buyers did not believe in the frost. With the news of the armistice, Brazil markets went wild; and Santos 4s, which had sold at eight and one-quarter cents in May, were quoted at twenty and one-half cents by December 10.

The food administration had decided, on February 6, 1918, after consulting the committee appointed by the Exchange, and on their advice and recommendation, to permit trading in futures on the following plan:

Comments (0)