All About Coffee by William H. Ukers (best new books to read .TXT) 📕

CHAPTER II

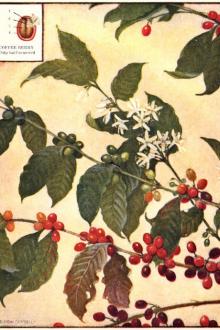

HISTORY OF COFFEE PROPAGATION

A brief account of the cultivation of the coffee plant in the Old World, and of its introduction into the New--A romantic coffee adventure Page 5

CHAPTER III

EARLY HISTORY OF COFFEE DRINKING

Coffee in the Near East in the early centuries--Stories of its origin--Discovery by physicians and adoption by the Church--Its spread through Arabia, Persia, and Turkey--Persecutions and Intolerances--Early coffee manners and customs Page 11

CHAPTER IV

INTRODUCTION OF COFFEE INTO WESTERN EUROPE

When the three great temperance beverages, cocoa, tea, and coffee, came to Europe--Coffee first mentioned by Rauwolf in 1582--Early days of coffee in Italy--How Pope Clement VIII baptized it and made it a truly Christian beverage--The first Europe

Read free book «All About Coffee by William H. Ukers (best new books to read .TXT) 📕» - read online or download for free at americanlibrarybooks.com

- Author: William H. Ukers

- Performer: -

Read book online «All About Coffee by William H. Ukers (best new books to read .TXT) 📕». Author - William H. Ukers

Green coffee is sold in London by auction in Mincing Lane. On arrival, it is stored in bonded warehouses, and is released for domestic use only when customs duty at the rate of four and one-half pence per pound has been paid. The bulk of the coffee comes in parchment on consignment; and before sale, it must be hulled and sorted in the milling establishments, most of which are on the banks of the Thames.

The auctions are held four times a week, usually on Tuesday, Wednesday, Thursday, and Friday. The sales are advertised in the market papers—chief among which is the Public Ledger—and also by the auctioneers, who issue catalogs of their offerings. A few hours before the beginning of the sale, samples are laid out for inspection by prospective buyers, who may cup-test them if they desire. The actual selling is done by competitive cash bidding, the highest bidder becoming the owner. Two classes of brokers do the bidding, one for home trade and the other for exporters.

Home trade takes about a tenth of the coffee, the remainder being sold for export. If the coffee is bought for re-export, it can be transferred to the shipping port, still in bond, and shipped out of the country without paying duty. During the World War, auctions were held about twice a week; but after the signing of the armistice in November 1918, the London traders resumed the four times a week practise.

Green Coffee Stored on the Docks at Havre, France Green Coffee Stored on the Docks at Havre, France

HANDLING GREEN COFFEE AT TWO EUROPEAN PORTS

New York Coffee and Sugar Exchange

The building fronts on Hanover Square and extends through to Beaver Street. The exchange rooms are indicated by the arched windows on the second floor. The rest of the building is devoted to offices. The exchange was founded in 1881, and was the first national coffee trading organization in the world.

Coffee Exchanges and Trading Methods

Green-coffee buyers in the large importing centers of the United States and Europe recognize two distinct markets in their operations. One of these is called the "spot" market; because the importers, brokers, jobbers, and roasters trading there deal in actual coffee in warehouses in the consuming country. In New York the spot market is located in the district of lower Wall Street, which includes a block or two each side on Front and Water Streets. Here, coffee importers, coffee roasters, coffee dealers, and coffee brokers conduct their "street" sales.

The other market is designated as the "futures" market; and the trading is not concerned with actual coffee, but with the purchase or sale of contracts for future delivery of coffee that may still be on the trees in the producing country. Futures, or "options" as they are frequently called, are dealt in only on a coffee exchange. The principal exchanges are in New York, Havre, and Hamburg. New Orleans and San Francisco exchange dealers trade on their local boards of trade.

Coffee-exchange contracts are dealt in just like stocks and bonds. They are settled by the payment of the difference, or "margin"; and the option of delivering actual coffee is seldom exercised. Generally, the operations are either in the nature of ordinary speculation on margin or for the legitimate purpose of effecting "hedges" against holdings or short sales of actual coffees.

The New York Coffee and Sugar Exchange—the most important in the world, because of the volume of its business—deals in all coffees from North, South, and Central America, the West Indies and the East Indies (except those of the Robusta variety) and uses Type No. 7 as the basis for all Exchange quotations. All other types are judged in relation to it. In determining the number of a type, the coffee is graded by the number of imperfections contained in it.

These imperfections are black beans, broken beans, shells, immature beans ("quakers"), stones, and pods. For counting the imperfections, the black bean has been taken as the basis unit, and all imperfections, no matter what they may be, are calculated in terms of black beans, according to a scale, which is practically as follows:

Black-Bean Scale 3 shells equal 1 black bean 5 "quakers" equal 1 " " 5 broken beans equal 1 " " 1 pod equals 1 " " 1 medium size stone equals 1 " " 2 small stones equal 1 " " 1 large stone equals 2 to 3 " "

The Coffee Pit in the New York Coffee and Sugar Exchange The Coffee Pit in the New York Coffee and Sugar Exchange

By this scale a coffee containing no imperfections would be classified as Type No. 1. The test is made on one-pound samples. If a sample shows six black beans, or equivalent imperfections, it is graded as No. 2; if thirteen black beans, as No. 3; if twenty-nine black beans, as No. 4; if sixty black beans, as No. 5; if one hundred and ten black beans, as No. 6, and if more than one hundred and ten black beans, as No. 7 or No. 8. These two are graded by comparison with recognized exchange types. Coffees grading lower than No. 8 are not admissible to this country.

The quotation relationship of other types with the basic Rio No. 7 is shown in the table below.

By this scale one can determine that when Rio No. 7 is quoted at 17.10, Rio No. 2 is 18.60, Santos No. 3, 19.10, and Bogota No. 5, 18.10. The quotations are on the pound and cents basis.

SCALE OF QUOTATION RELATIONSHIP Brazilian Coffee—Not Santos Santos Coffee Other Kinds—Not Brazilian Type Type Type No. 1—180 points above No. 1—260 points above No. 1—300 points above No. 2—150 points above No. 2—230 points above No. 2—250 points above No. 3—120 points above No. 3—200 points above No. 3—200 points above No. 4— 90 points above No. 4—150 points above No. 4—150 points above No. 5— 60 points above No. 5—100 points above No. 5—100 points above No. 6— 30 points above No. 6— 50 points above No. 6— 50 points above No. 7—Basis No. 7—Basis No. 7—Basis No. 8— 50 points below No. 8— 50 points below No. 8— 50 points below A point is the hundredth part of a cent

In the spot market, a trader may also buy or sell coffee "to arrive"; that is, a consignment that is aboard ship on the way to the market. Coffee is shipped to New York either on a consignment basis and sold for a commission, or it may have been bought in the shipping port and be already the property of an importer. When shipped on consignment, a wholesaler usually buys on the in-store contract, which provides that the purchaser must take delivery at the warehouse, though he is generally given a month's storage privilege before removal of the coffee. The practise among New York importers at present is to buy coffee on either the basis of F.O.B. delivery steamer at loading port, or delivery C. & F. (cost and freight), or C.I.F. (cost, insurance, and freight), port of destination. Payment is made by letter of credit drawn on a New York or London bank, entitling the exporter to draw at ninety days' sight against the shipping documents, so that the shipment will be in the hands of the purchaser long before the draft is made. Frequently a jobber acts as his own importer of Brazil coffee, buying direct from the exporter without utilizing the agency of a broker or a regular importing firm.

Brazil coffee is bought with the stipulation that differences between samples and the coffee actually delivered may be adjusted either on "Brazil grading," "half difference," or "full difference"; and with the further provision that, if the delivery is a full type higher or lower than specified in the contract, the entire shipment may be rejected. Under the "Brazil grading" provision, the buyer must accept delivery if the coffee is better than the next lower type, even though not up to the type ordered; and if the coffee is of a higher type than contracted for, he need not pay premium for it. In buying on the "half difference" or "full difference" basis, the buyer is entitled to payment for half the difference or the full difference, respectively, for any undergrading, or must pay the seller accordingly if there is any overgrading. When a buyer specifies special features of description, in addition to type, some sellers protect themselves against claims for difference on this score by inserting in the contract a clause to the effect that the description is given in good faith, but is not guaranteed by the seller.

The one on the right is a record of transactions in the coffee pit. As soon as a trade is made, it is noted in the proper column on the lower part, the entry showing the time of the transaction, the number of "250-pound bag lots," and the price. The left-hand board gives Santos and Rio future quotations. For a detailed description of these and other exchange quotation boards, see page 457

How the New York Exchange Functions

When the New York Coffee Exchange was incorporated in 1881, its charter stated its purposes to be "to provide, regulate and maintain a suitable building, room or rooms for the purchase and sales of coffees and other similar grocery articles in the city of New York, to adjust controversies between members, to inculcate and establish just and equitable principles in the trade, to establish and maintain uniformity in its rules, regulations and usages, to adopt standards of classification, to acquire, preserve and disseminate useful and valuable business information, and generally to promote the above mentioned trade in the city of New York, increase its amount, and augment the facilities with which it may be conducted."

In the promotion of trade at New York the Exchange has been highly successful. From time to time it has been criticized; and, more than once, coffee traders in the East and in the West have raised a question as to its value to non-speculating members. There are those who believe it serves a useful purpose, and others who call it a huge pool room. To say that, on the whole, it is not of benefit to the trade would be untrue. As one of its champions pointed out in 1914, when it shut down for a period of four months on account of the World War:

The ability to discount the future is a necessity, and demands the facilities that a unit of centralization like the Exchange affords. There is no difference between a purchase of coffee and one of a future month on options.

The experience gained here and abroad demonstrates that any check placed upon such dealings is detrimental, with far-reaching effects upon the whole body of the trade. Unquestionably the Exchange is a powerful factor as a regulator of extremes in the market.

The experience gained in

Comments (0)